How to Read A PayCheck Stub – Information, Earnings & Deductions

Did you know that not everyone gets a paycheck stub? Whether you’re moving state and encountering one for the first time, or have recently graduated and have just earned your first paycheck, it’s important to understand the value and information it contains, such as earnings and any wage deductions.

The Fair Standards Labor Act (FSLA) requires employers to keep records of how many hours an employee has worked and the amount of money they were paid. But, it does not require that employers share this information with their employees.

However, in the absence of federal law, many states have statutes pertaining to pay statements. Colorado state law, for example, requires that employees receive paystubs from their employers at least once a month, which must list gross and net wages, as well as all deductions. Learn more about US paycheck law by state.

What Information Is Available On A Paycheck stub?

A paycheck stub summarizes how your total earnings were distributed. The information on a paystub includes how much was paid on your behalf in taxes, how much was deducted for benefits, and the total amount that was paid to you after taxes and deductions were taken.

Paycheck stubs are normally divided into 4 sections:

- Personal and Check Information

- Earnings

- Deductions

- Withholding

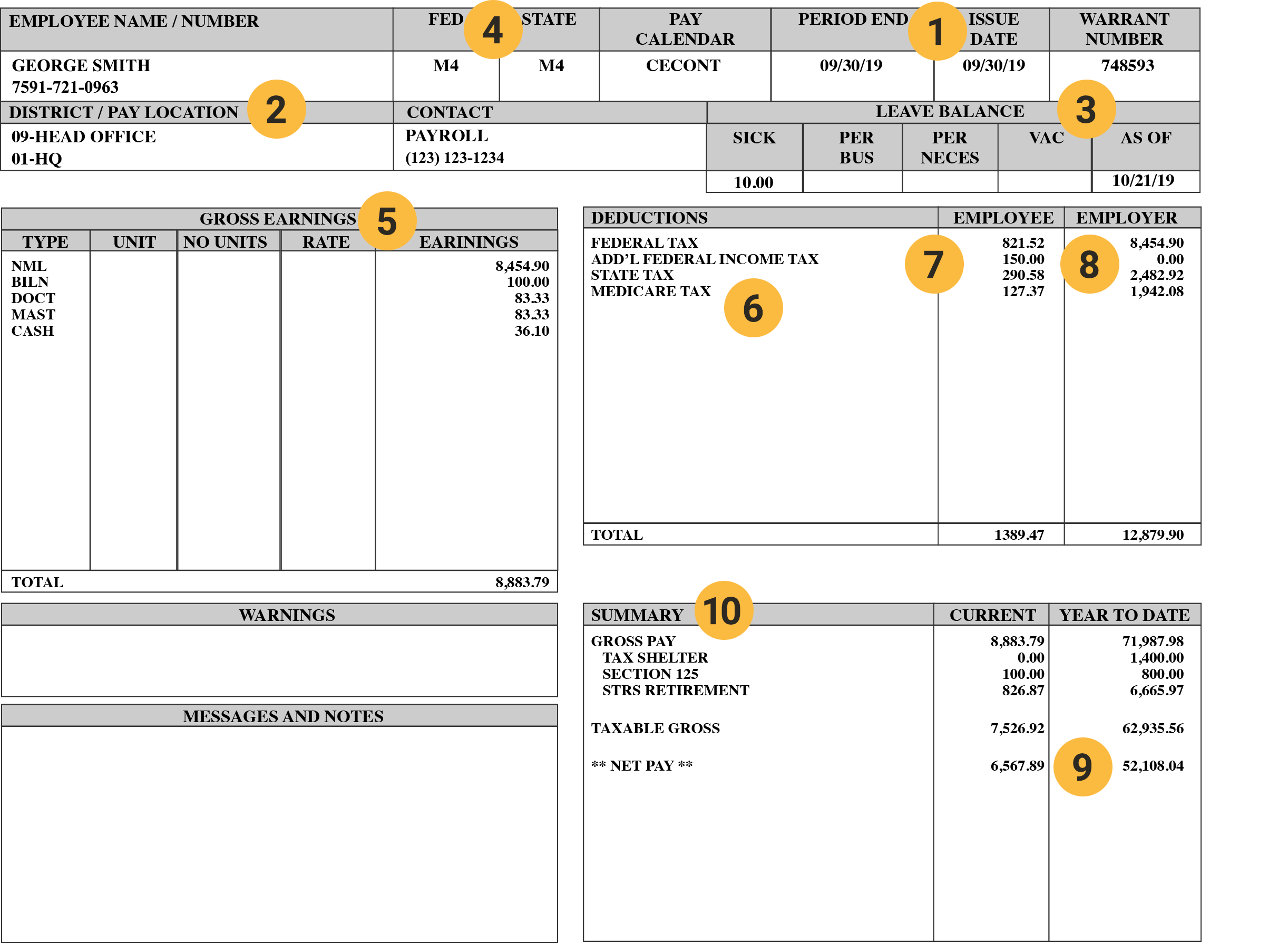

How to Read a Paycheck Stub – An Example

- This section shows the beginning and ending dates of the payroll and the actual pay date.

- This is your home address

- This is the information about your specific job

- This is your Federal and State filing status

- These are your current and year to date hours and earnings

- Federal and State current and year to date taxes withheld

- Before Tax Deductions

- After Tax Deductions

- Employer Paid Benefits. This is the portion of your benefits paid by your employer, not deductions from your earnings.

- This is the summary section of the pay stub

What’s On A Paycheck Stub?

Personal and Check information includes your personal information, filing status (single or married), as well as the withholding number, according to your IRS form W-4.

The earnings section shows your earnings from the pay period and includes overtime. It also shows pre-tax deductions for different employee benefits that you may receive, such as health insurance and retirement contributions.

Deductions shows any additional deductions that might be taken out of your paycheck after tax, like group life or disability insurance.

Withholding refers to the money that your employer is required to take out of your paycheck on your behalf. This includes federal and state income tax payments, Social Security, Unemployment Insurance, and Worker’s Comp.

Understanding Paycheck Stub Deductions

Common pay stub deductions include federal and state income tax, as well as Social Security. These federal and state withholdings account for much of the difference between your gross income and net income. There may be other deductions as well, depending on the programs that you sign up for with your employer.

How Much Tax Is Taken Out Of A Paycheck?

In a payroll period, the taxes deducted from a paycheck typically include Social Security and Medicare taxes, otherwise known as FICA (Federal Insurance Contributions Act). The following taxes and deductions are what you can expect to see on your paycheck, explained in detail below.

Federal Income Taxes

The federal government is entitled to a portion of your income from every paycheck. This is known as your withholding tax — a partial payment of your annual income taxes that gets sent directly to the government. These payments are managed by the IRS.

The amount of money withheld for federal taxes depends on the amount of money that you earn and the information that you gave your employer when you filled out a W-4 form, or Employee’s Withholding Allowance Certificate.

For every allowance you take, less money gets withheld for federal taxes and more money gets added to your paycheck. Take fewer allowances, and a bigger chunk of your income will be withheld for your federal taxes.

State Taxes

Depending on where you live, you may or may not be required to pay a state income tax. As with federal taxes, money for state taxes is withheld from every paycheck.

Social Security

The federal government requires every working American to contribute a portion of their paycheck to Social Security, a system of supplemental retirement programs established in 1935. The Social Security fund provides benefits to current Social Security recipients.

Under federal law, each worker contributes 6.2% of their gross income directly into the Social Security fund, and every employer adds an extra 6.2% for each employee.

If you noticed an increased gross pay towards the end of 2020, this may be due to former President, Donald Trump, enacting the order ‘Deferring Payroll Tax Obligations in Light of the Ongoing COVID-19 Disaster’ on August 8th, 2020. This order allowed employers to defer the employee section of Social Security payroll taxes for specific individuals in the final four months of 2020. These deferred taxes were due over the time period of January 1st – April 30th, 2021, but the Consolidated Appropriations Act deferred this due date to December 21 2021

Medicare

The federal government requires every working American to contribute to Medicare, a U.S. government insurance plan that provides hospital, medical and surgical benefits for Americans aged 65 and older, and for people with certain disabilities. Every worker contributes 1.45% of their gross income to Medicare and every employer pays an additional 1.45% on behalf of each employee.

Insurance

If you signed up for medical, dental or life insurance through your employer, your contributions to these plans will be deducted from your pay as well.

Retirement Savings Plans

Contributions to retirement savings plans such as a 401K plan will also be deducted from your pay. When you sign up for a 401K plan, you select a percentage of your pre-tax salary that you’d like to contribute to your retirement account.

Flexible Spending Accounts

A flexible spending plan allows you to set aside pre-tax dollars for medical expenses including health insurance copayments, deductibles and prescription drugs. Contributions to a flexible spending account are deducted from your pre-tax income.

Health Savings Accounts

A health savings account is another way to put pre-tax dollars aside in a special account for medical expenses. To be eligible for a health savings account, you’ll need to select a high-deductible health insurance plan. Contributions to a health savings account are deducted from your pre-tax income.

Why Do You Need To Understand Wage Deductions?

Each pay stub includes year-to-date fields for each withholding category so you can track how much money you’ve paid for taxes, Social Security and Medicare throughout the year. Many employers include a similar listing for contributions to retirement savings plans and health plans. You’ll generally see these fields marked as the acronym “YTD” (year-to-date) on your pay stubs.

Any errors in your deductions are your responsibility to report. The last thing you want is for an error to be repeated through several pay periods. If you have questions about any of the information listed on your pay stub, be sure to contact your payroll provider.

What Are Gross Earnings On A Paycheck?

A pay stub also lists gross and net income to-date. This means you know exactly how much money you are taking home. This allows you to accurately and confidently plan your monthly and yearly budgets.

Be sure to check that the information on your last pay stub of the year matches the information on your W-2 form, which details your wages and taxes paid for the year.

Paycheck Stub Deduction Codes – What Do They Mean?

Below, you will find some of the most common deduction codes that appear on your pay stub. Common pay stub deduction codes include the self-explanatory 401K for retirement savings contributions and 401K ER, which refers to an employer’s contribution if the employee receives a company match. However, this is by no means an exhaustive list.

Many companies list codes on their paycheck specific to how they do business or the benefits they offer to employees. For example, some businesses may list health insurance as HS while others may call it HI. Unions, savings funds, pensions, organizations and companies all have their own codes too, any of which could appear on your paycheck, depending on your circumstances.

| Code | Definition |

|---|---|

| Gross Pay | This is the amount of money earned during the pay period |

| FED / FIT / FITW | Federal Income Tax Withheld |

| STATE / SIT / SITW | State in which you earned money |

| OASDI / FICA / SS / SOCSEC | Social security tax |

| MED | Medicare tax |

| FSA / HSA | Flexible Spending Account and Health Savings Account |

| 401(k) | This notes how much you’re putting into your company’s retirement account |

| Net Pay | This is the final amount, after deductions |

| GARN | Wage garnish |

| CHSPPRT | Child support payments |

| LV / LEVY | Tax levies |

Experiencing Pay Stub Problems?

A pay stub should accurately determine an employee’s pay within a payroll period. It can even be used as evidence to either settle a dispute, or check for any discrepancies in pay.

Find out more about international payroll, and HR and payroll in the US.